- #Bitsafe iban drivers#

- #Bitsafe iban free#

If the platform offers SEPA payments, free.

#Bitsafe iban free#

If the platform offers a payment in Euros option, free. If the platform offers a Bitsafe option, free. Getting Money IN (ie getting paid by Platforms) It’s not money laundering unless the source of funds was illegal or it’s tax shenanigan’s. If you’ve told them something else though and your bank is the Good Christian Trump Bank Of Our Lord USA, have a Plan B.īut you could, give the club (or a friend who knows your real name) the cash for them to bank, and send equal funds to your Bitsafe. TBH your existing bank is probably fine with your cash, if they know what you do. In my Bitsafe account only the name of the bank, it’s IBAN/BIC and ref notes show up. I sent myself money from a personal account in the UK to my personal Bitsafe account. As such I would expect this to allow a Trading As style, which would hide your real name, but I haven’t checked, so, ask. SWIFT, I can’t speak to, but no one uses that for small transactions anyway.īitsafe also offer a BUSINESS account. This is the “FSSW not wanting to give their client their real name” issue. Very useful if you spend time in Euro countries OR live somewhere that would otherwise need SWIFT. You can also have a Bitsafe Debit Card if you like and just spend on it. This way your bank can no longer see where your money comes from – OF, MV etc – and their delicate sensibilities will remain unperturbed, and your main banking continues. Then just have Bitsafe send the money to your main bank account. So, try them.Īccept payments from Platforms and other adulty sources. Nothing from OF, MV or anyone else that might give them conniptions.Ĭertainly they seem fine with Europeans, Brits, Canadian, Americans etc. All your bank sees is that you are sending money from your account somewhere else (Bitsafe), to your account with them, and “nothing to see here”. Then you simply do a transfer from your Bitsafe to your bank. It lets you have your scary payments – e.g. How does it protect my main bank account? No more wondering if a prude at your bank will tell you to bank elsewhere because you got paid by OF. Yes – they are fine with how we earn our living, inc FSSW. So, I found it when it turned up as a payout option under ManyVids, so, looked into it, and opened an account. PROTECT YOUR BANK ACCOUNT by routing all the scary adult industry payments via Bitsafe. #Bitsafe iban drivers#

Taxi drivers will normally be told to open a Business Account. As more people have an MV and OF and AW, banks are starting to notice what those incoming payments mean.īanks do not like Personal Accounts being used for Business purposes : This is actually a general rule, and even taxi drivers etc can get caught out.

Not all of them, not all banks, but even if your bank is cool, now, if they change their mind, you’re toast.īanks do not like Adult : Some close accounts because they have objections to our industry. In doing so, it hides the source of your income from nosey banks.īanks are closing adult industry accounts. It’s basically a Collections Account – it collects all your money from platforms etc, for you do with as you like – send to your main bank, or spend using their card.

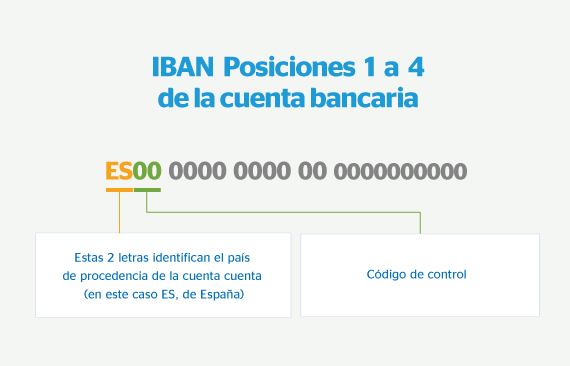

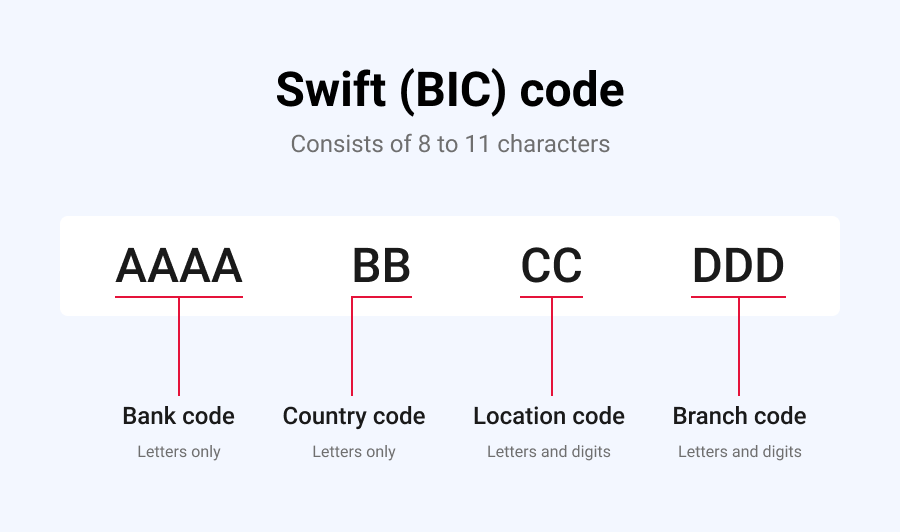

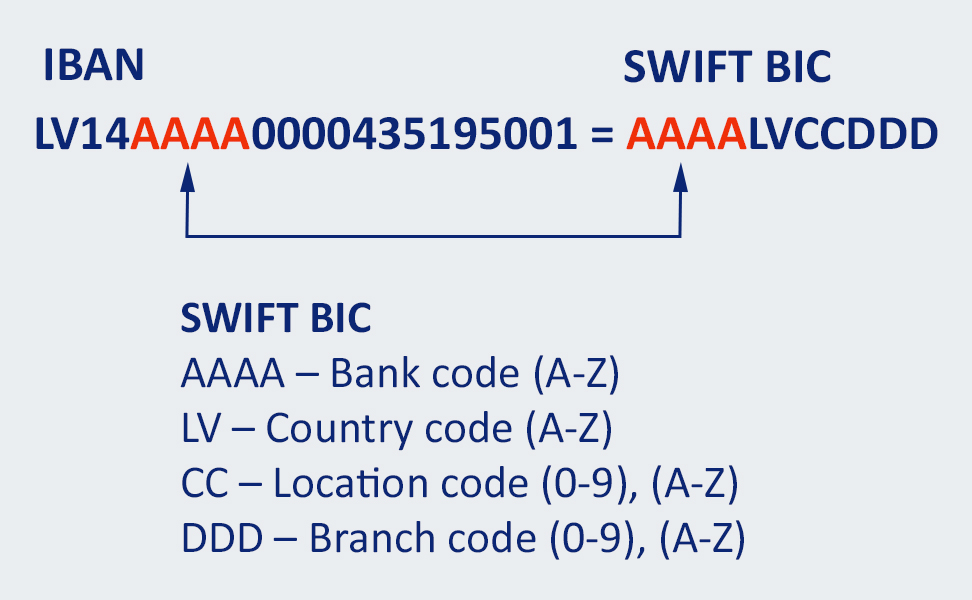

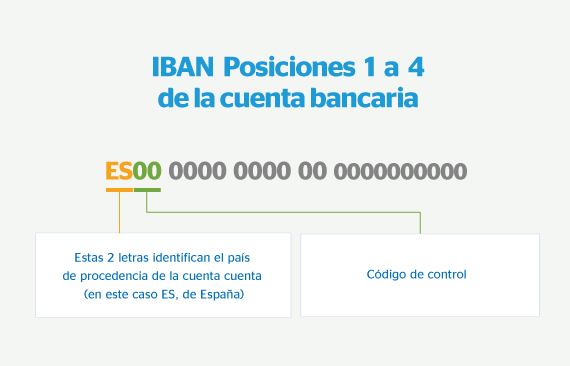

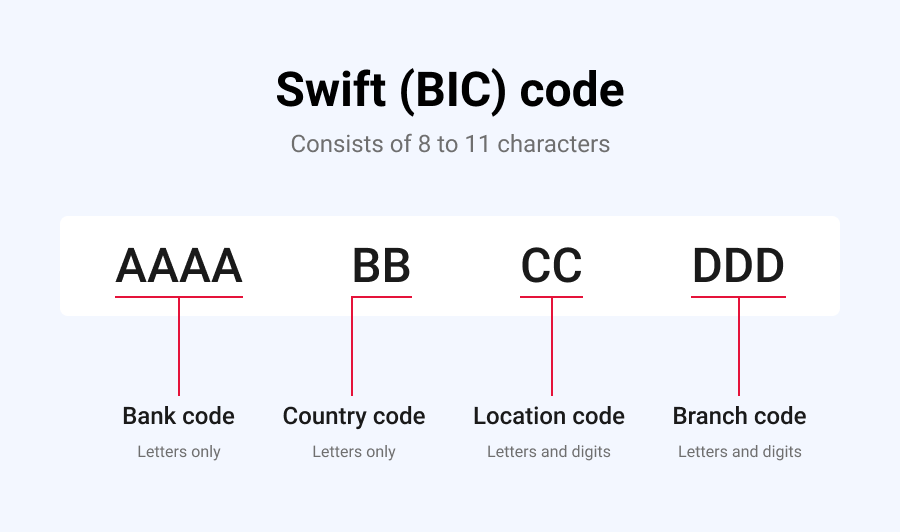

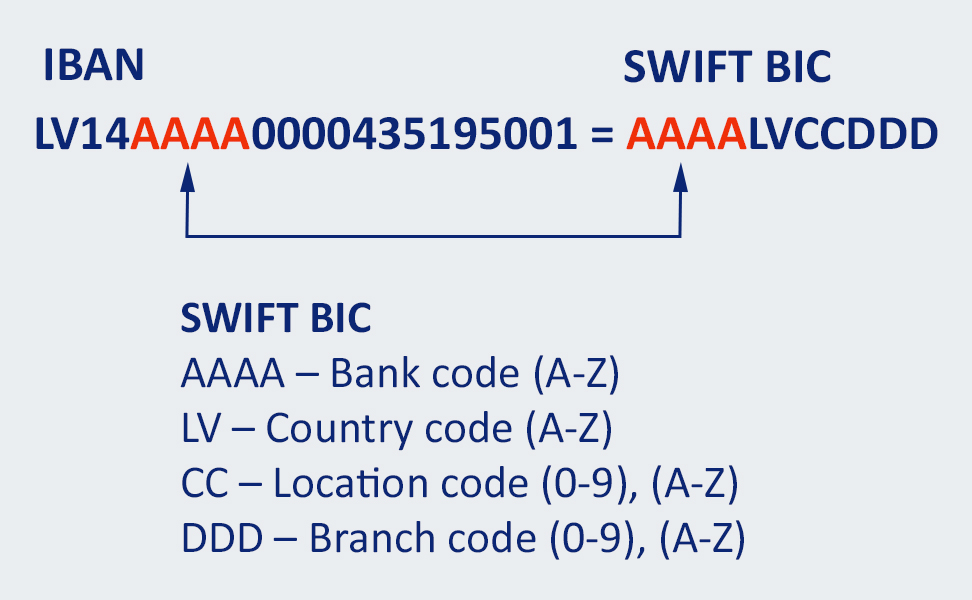

The SEPA B2B Direct Debit Transfer is only available between businesses, and banks participating in the SEPA scheme may choose to offer it to their customers, but it is not mandatory.Bitsafe, is BRILLIANT! at protecting your bank account. The SEPA Core Direct Debit Transfer is available to individuals, and must be offered by all banks participating in the SEPA scheme. There are two types of SEPA Direct Debit Transfers: This can be especially useful if you’d rather have your bill payments automatically taken out from your account each month, rather than remembering to pay the bill on time yourself. Before any money can be transferred, the sender must sign a “mandate,” which is a contract that allows the recipient of the funds to take money out from the sender’s account on a recurring basis. But because the SEPA Direct Debit Transfer works as a “pull-based” method of payment, it’s slightly different to other SEPA transfers-in this case, the roles are reversed and the recipient of the funds must request the money transfer from the sender.įirst, the recipient who will receive the funds must send a request to the sender to allow the money to be withdrawn (i.e. Similar to the other SEPA transfers, the SEPA Direct Debit Transfer also requires the IBAN- and occasionally the BIC-of both the sender and the recipient’s bank accounts. Some examples of recurring payments may include your monthly rent, internet or electricity bills, or regular loan repayment installments.

The SEPA B2B Direct Debit Transfer is only available between businesses, and banks participating in the SEPA scheme may choose to offer it to their customers, but it is not mandatory.Bitsafe, is BRILLIANT! at protecting your bank account. The SEPA Core Direct Debit Transfer is available to individuals, and must be offered by all banks participating in the SEPA scheme. There are two types of SEPA Direct Debit Transfers: This can be especially useful if you’d rather have your bill payments automatically taken out from your account each month, rather than remembering to pay the bill on time yourself. Before any money can be transferred, the sender must sign a “mandate,” which is a contract that allows the recipient of the funds to take money out from the sender’s account on a recurring basis. But because the SEPA Direct Debit Transfer works as a “pull-based” method of payment, it’s slightly different to other SEPA transfers-in this case, the roles are reversed and the recipient of the funds must request the money transfer from the sender.įirst, the recipient who will receive the funds must send a request to the sender to allow the money to be withdrawn (i.e. Similar to the other SEPA transfers, the SEPA Direct Debit Transfer also requires the IBAN- and occasionally the BIC-of both the sender and the recipient’s bank accounts. Some examples of recurring payments may include your monthly rent, internet or electricity bills, or regular loan repayment installments.

In contrast to the SEPA Credit Transfer and the SEPA Instant Credit Transfer, the SEPA Direct Debit Transfer is frequently used for recurring payments.

0 kommentar(er)

0 kommentar(er)